Key factors play into a predictable work rhythm that leaders must take into consideration, such as shared situational awareness, timely information sharing, and laying the groundwork for collaboration to exist.

Without an intentional operating rhythm that suits your team, customer experience will suffer and market opportunity will be missed as team members will spend extra unnecessary time seeking out what they need to accomplish everyday tasks. If existing meetings aren’t productive and space for asking questions isn’t provided, leaders should think about reconfiguring those meetings and ensuring the right team members are present.

This is especially important as hybrid and remote work have become more pervasive. Managers worry about what productivity might be lost as more employees work from home, yet employees who see performance and returns near all-time highs feel that no productivity was lost. A cadence and rhythm can help bridge this gap as organizations and individual teams still search for the right balance.

Both acknowledging and understanding productivity patterns can also help leaders and their teams anticipate and combat recurring slumps, regardless of whether they have full control over their work schedules.

How We’ve Worked With Clients to Address These Challenges

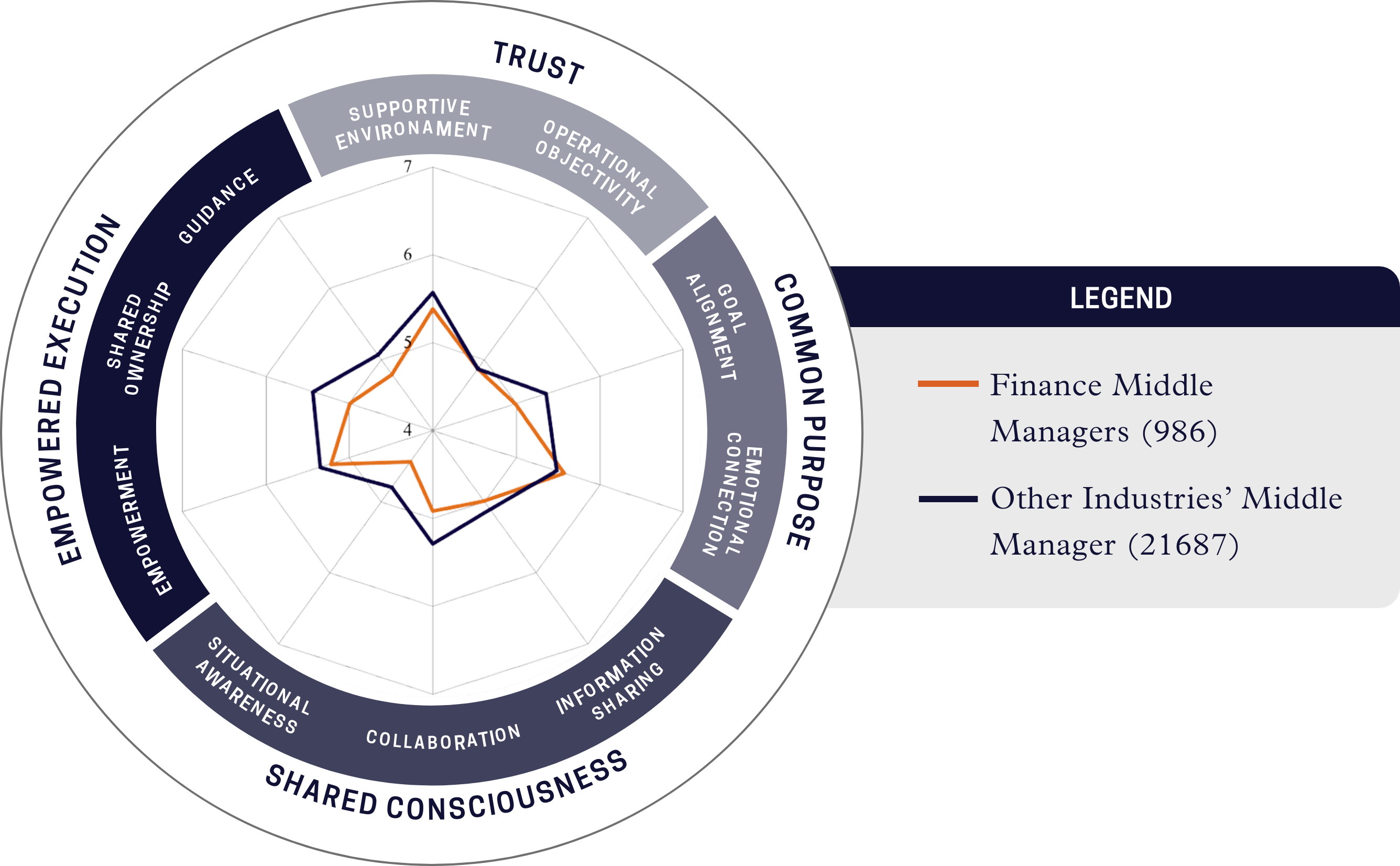

McChrystal Group partnered with a leading financial services provider to help leaders better understand and evaluate how their behaviors impacted the culture and workflow of their teams.

The organization was struggling with increased market competition and changing customer needs while having to address structural and behavioral barriers within the organization that was inhibiting collaboration and effective information sharing.

Relevant and key information possessed by top-level leaders needed to be leveraged in order for financial advisors to deliver holistic investing and banking solutions to their clients, yet a lack of faith in the teams of the larger enterprise existed, inhibiting this behavior.

With more than 500 leaders participating in different forms of leader development focused on changing behaviors, trust was instilled among teams leading to increased collaboration and eventually resulting in a cultural shift.

A people-first strategy was specifically designed and implemented for the organization, consisting of a mentoring program, team-building initiatives, and career development programs across all levels. Following the first year of the strategies being implemented throughout the organization, 82% of those surveyed said the initiative had a positive effect on collaboration across teams.

By establishing a tailored communications flow for different teams throughout the organization, it allowed for transparent discussions around internal processes and work rhythms. This new approach gave the organization's teams the trust necessary to leverage the resources of the larger enterprise teams and support growth and client experience delivery.

Through targeted leadership training and a focus on improved and timelier communications, leadership saw lower attrition and higher morale at the organization.

Work rhythms are directly tied to a sense of engagement, and as a result, retention. Attrition and turnover in the financial services sector have accelerated in recent years, requiring the attention and focus of leaders.

Without connecting an organization through collaboration and information sharing, engagement and motivation will lag. If your team or an individual employee isn't engaged, leaders may notice that they withdraw from the team and colleagues, their quality of work declines, they lack enthusiasm for their work, or they begin to check out of conversations.

This is the latest in a multi-part series of industry insights utilizing McChrystal Group’s proprietary data to highlight industry specific insights and strategies leaders can adopt to address them.