A Team of Teams® Operating Guide for Fintech

The pace of change outstrips most organizations’ ability to execute. New technologies arrive faster than organizations can operationalize them. First-to-market, progressive differentiation, and scale considerations remain paramount. External conditions shift before internal systems catch up. Leaders must evolve while navigating competitive, regulatory, economic, and geopolitical environments that vary by market and compound organization complexity.

In fintech, executives’ focus is stretched across product development, go-to-market, regulatory compliance, and ecosystem connectivity, oftentimes taking time away from optimizing the organization’s operating system to enable strategic objectives to be met as efficiently as possible. This leaves leaders forced to reconcile these competing demands: move fast without losing precision, innovate without eroding discipline, and adapt without fragmenting the organization.

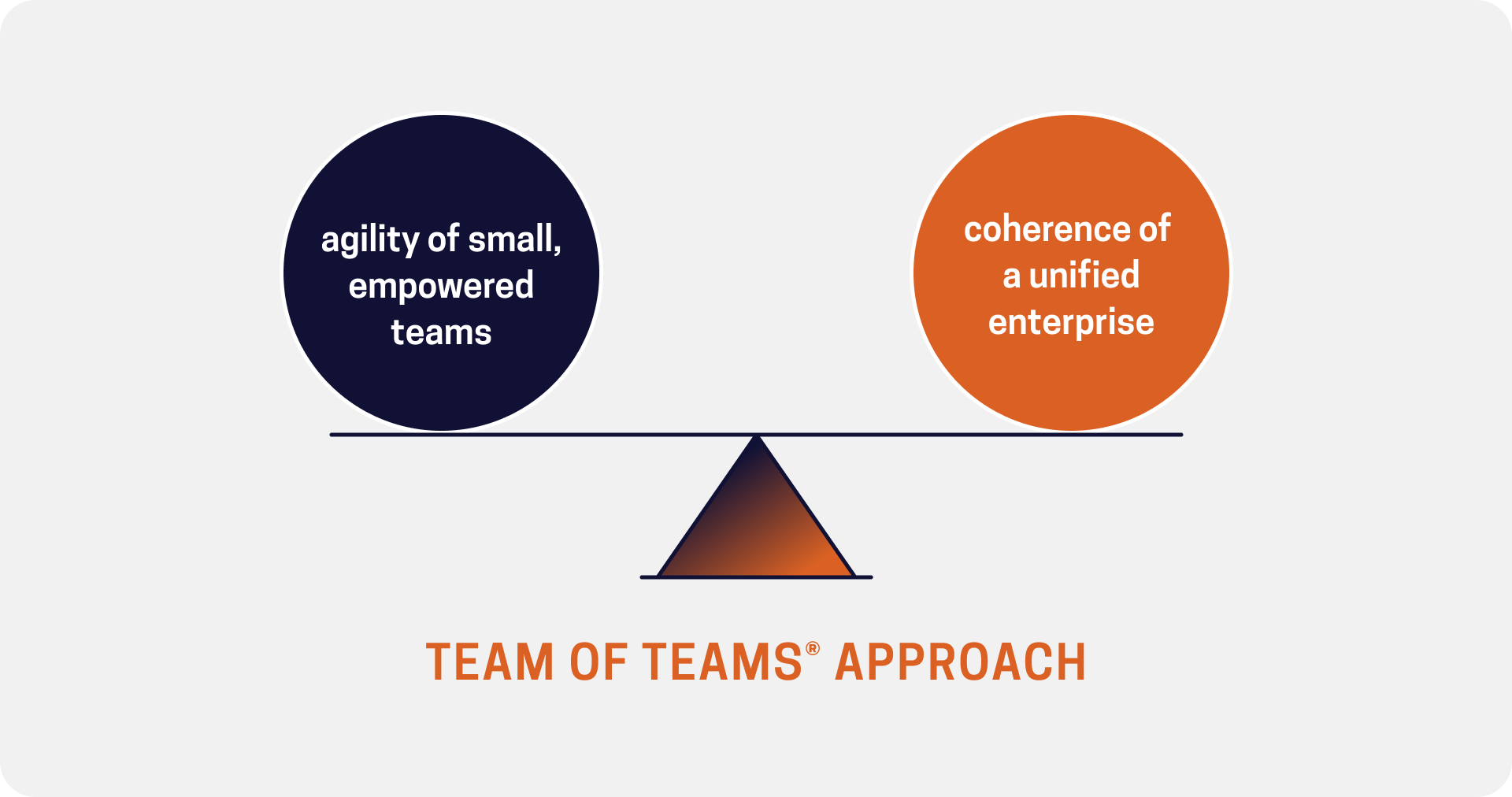

At its core, this is not a fintech problem. It’s a leadership and operating model problem. This execution tension is precisely what McChrystal Group’s Team of Teams® approach is designed to resolve. It leverages two qualities that are often seen as opposites: the agility of small, empowered teams and the coherence of a unified enterprise. Team of Teams is successful because it creates a shared consciousness that ties everyone together and empowers execution, allowing teams to move without hesitation. It builds trust and a common purpose that teams need to coordinate faster than the problems they face.

These principles matter wherever speed determines competitive advantage; however, Financial Technology exposes the consequences faster than most. The fintech industry has become one of the most unforgiving proving grounds for modern organizational design. This is not solely a function of innovation; companies must also grow while remaining aligned with regulators, partners, investors, global customers, and end users. The environment punishes both hesitation and disconnection from market stakeholders. It rewards organizations that can learn, adapt, synchronize, and innovate at scale.

Fintech: A Proving Ground for Execution

Over the past quarter-century, fintech has compressed financial innovation cycles and exposed the limits of traditional operating models. It is no longer a niche category but a defining force in the global economy. From digital wallets and real-time payments to lending platforms and embedded finance, the industry has pushed financial systems toward greater speed and accessibility. In many developing markets, fintech has provided the first formal financial tools people have ever had, from Safricom’s M-PESA in East Africa to the rollout of India’s United Payments Interface (UPI) to coincide with the country’s demonetization policies.

But with each success, there come new challenges. The very speed and growth that fuels the sector also create pressure. Rapid innovation is no longer enough. Companies must innovate while coordinating across borders, responding to regulatory changes, partnering with incumbents, and competing with aggressive and well-funded firms. Growth creates complexity, which slows organizations unless they are built to absorb it.

Many fintechs are caught in this bind. They have product vision and market traction, yet the organization beneath them has not matured. The result? A widening gap between ambition and the organization's ability to execute at scale.

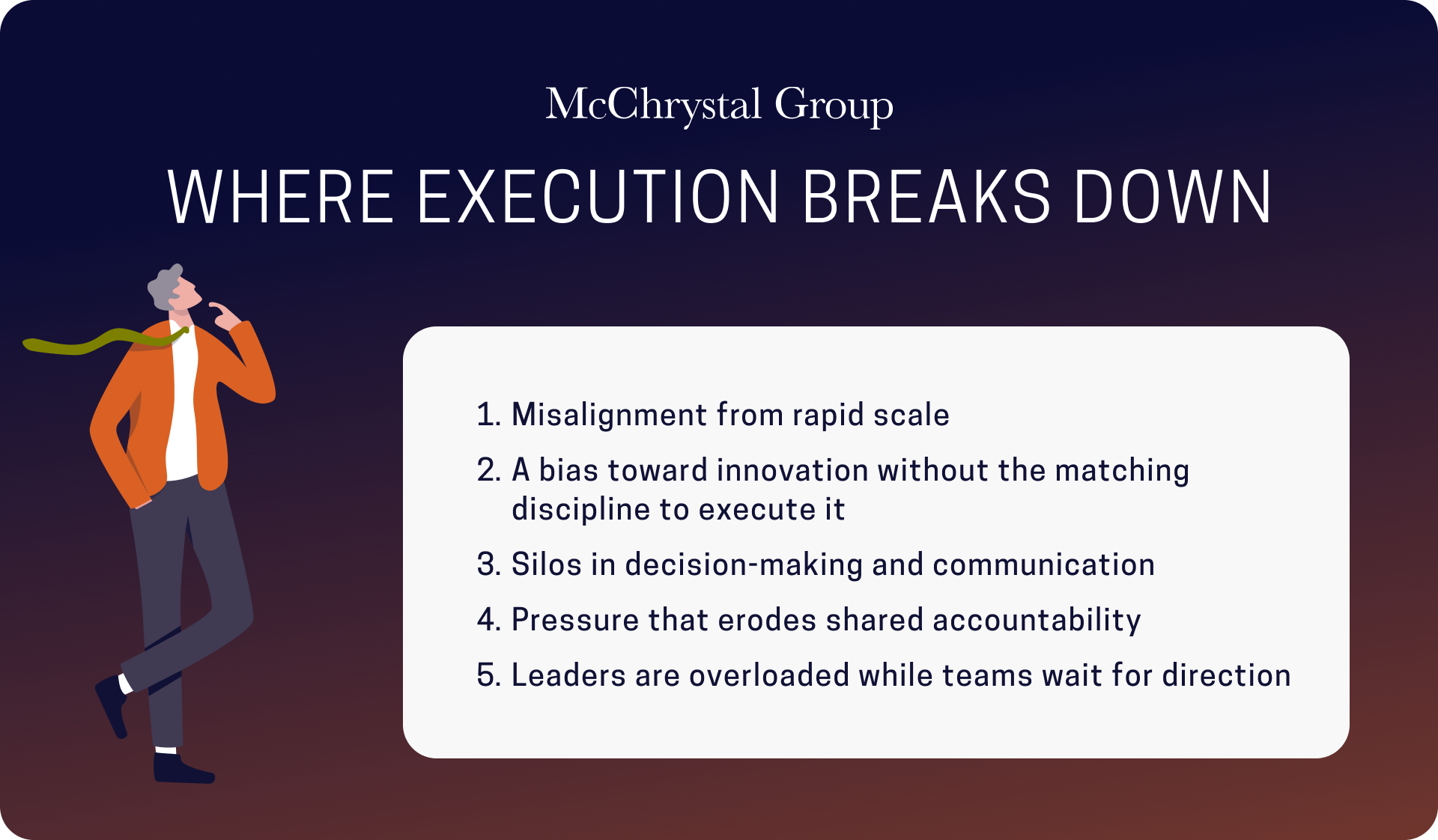

Where Execution Breaks Down

Several recurring patterns show up across the industry:

1. Misalignment from rapid scale

Hiring accelerates. New products launch. Markets open. But the internal structure often lags. The result is unclear accountability, overlapping responsibilities, and minimal cross-functional transparency, which together slow decision-making. Employees who rate their organization’s alignment highly are twice as likely to be engaged.

2. A bias toward innovation without the matching discipline to execute it

Speed is celebrated, but internal consistency and standard ways of working do not keep pace. Experimentation becomes the norm, but discipline becomes uneven. Those who are especially adept at prioritizing their time and resources are 44% more likely to report confidence in leading teams.

3. Silos in decision-making and communication

As companies grow, teams drift. Priorities are interpreted differently across functions and geographies. Coordination requires more effort than it should. McChrystal Group research found that only 33% of employees felt decisions in their organization are made in time for execution.

4. Pressure that erodes shared accountability

High-performing teams chase local targets and quarterly outcomes. Without strong connective tissue, collective success becomes secondary. People in well-connected organizations are 50% more likely to agree that their organization adapts its strategies to environmental changes.

5. Leaders are overloaded while teams wait for direction

Approvals accumulate at the top. Teams hesitate. Leaders do not intend to slow execution, yet the structure forces it. Only 23% of leaders self-report delegating decisions to the level closest to the issue at hand.

These challenges are not unique to fintech, but in fintech, their consequences surface faster, at full volume, and with less margin for error. The pressures of the fintech landscape magnify every weakness.

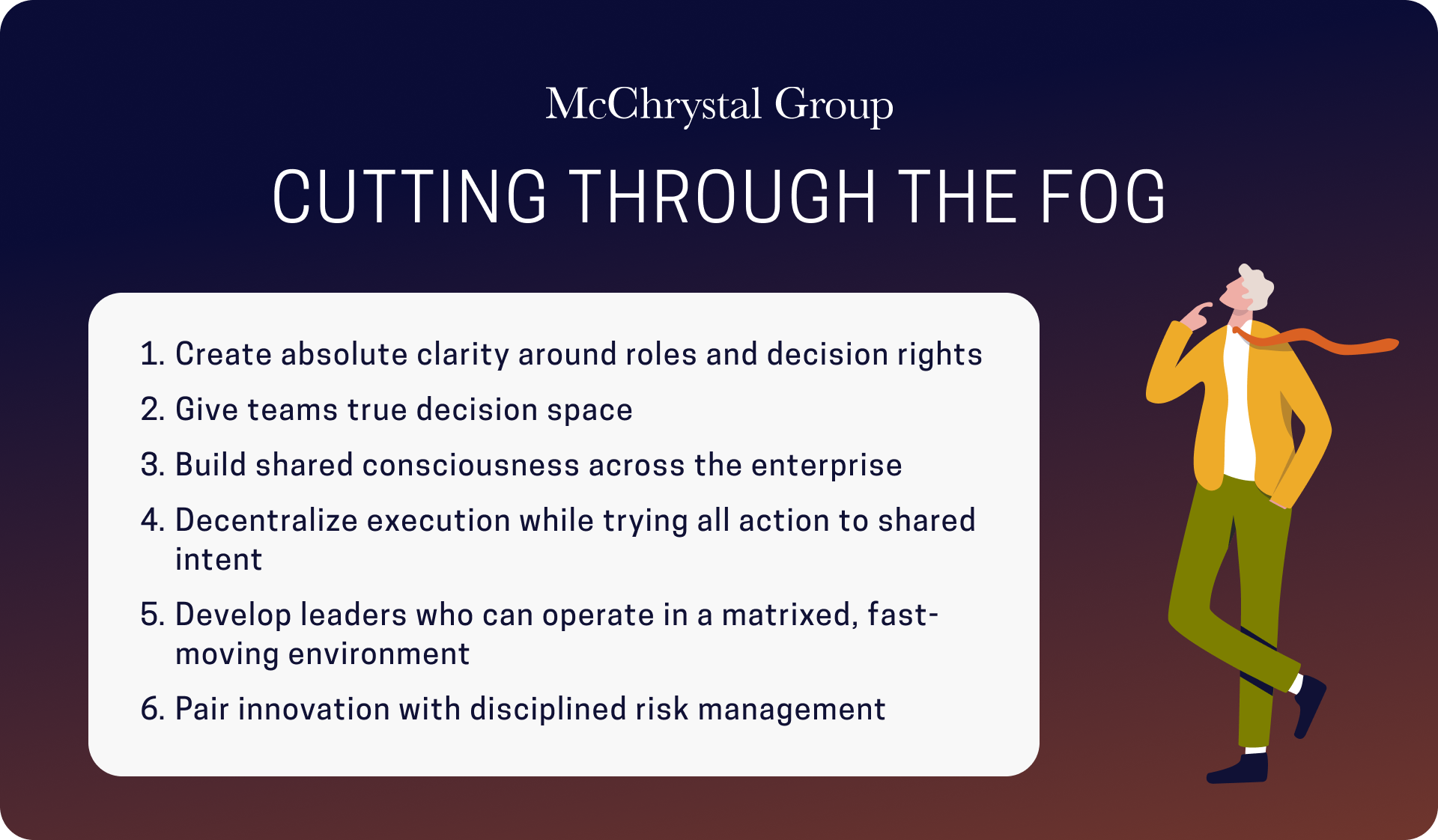

Cutting Through the Fog

Team of Teams offers a practical blueprint for cutting through the fog of execution that scale inevitably creates. The goal is not to choose speed or stability, but to design a system where both reinforce each other. Doing so requires six foundational moves:

1. Create absolute clarity around roles and decision rights

People cannot move quickly if they do not know where authority sits. Mapping the decision space across the organization reduces hesitation and prevents decisions from becoming stuck.

2. Give teams true decision space

Empowered teams move faster. But empowerment needs boundaries. When teams understand where they can act independently, they take ownership and avoid unnecessary escalation.

3. Build shared consciousness across the enterprise

Alignment does not happen passively. It comes from deliberate communication rhythms, cross-functional forums, transparent dashboards, and operating reviews that ensure everyone sees the same picture of reality.

4. Decentralize execution while tying all action to shared intent

Local teams must be free to move quickly, but they cannot drift. Strategic intent anchors decisions so teams remain flexible without fragmenting.

5. Develop leaders who can operate in a matrixed, fast-moving environment

Leaders need the ability to influence without relying on formal authority. They must create clarity, build trust, and guide teams through ambiguity.

6. Pair innovation with disciplined risk management

Fintech moves quickly, but it also lives under close regulatory scrutiny. Teams must understand the company’s risk appetite and compliance posture so innovation strengthens the enterprise rather than exposes it. Risk functions inside fintechs must be integrated across teams to enable compliant innovation at speed and scale.

Designing A Model for Long-Term Performance

For a fintech company with ambitious goals, setting up these mechanisms is not a luxury. It is essential. The ability to scale no longer rests solely on product quality or engineering talent. It rests equally on how well teams are aligned, quickly information moves, and disciplined decision making is across the organization.

Companies that win in this environment treat their operating model as seriously as their product roadmap. They invest in systems, forums, and cultural practices that sustain team cohesion and empowerment as the organization grows more complex. They treat clarity and coordination as strategic advantages. They learn to move as a unified network of teams rather than a hierarchy of disconnected functions.

And in doing so, they resolve the tension that defines the modern fintech landscape. They operate with the speed their market demands and the precision their regulators require. They innovate at the edge while staying anchored in shared understanding. They grow without losing coherence.

Fintech is often described as fast-moving, disruptive, and essential to social and economic development. But beneath the technology is a more profound lesson. In a world that seems to be spinning faster, advantage no longer comes from innovation alone. It comes from building organizations that can decide, adapt, align, and execute with the speed needed to beat complexity.