With the herculean efforts that go into closing an M&A deal, it can be easy to forget that analysis generally puts the typical M&A failure rate at 70%-90% 1. What do companies need to do differently? Based on our experience working with companies that have recently undergone major mergers and/or acquisitions, these are the top three things you need to do quickly to succeed:

- Align your leadership against a well-defined strategy and push that new direction out across all of the merged/acquired entities.

- Identify and rally around your new core group of most impactful people and minimize regrettable attrition.

- Structure the organization and processes to connect the right teams, leverage best practices, and achieved desired synergies.

Aligning the Organization: A New PowerPoint Presentation Isn’t a New Strategy

Most executives understand the importance of quickly defining a strategy for their newly formed organization, but many underestimate the scale and scope of efforts to ensure that senior leadership truly understands and supports that strategy. Far too often, we’ve seen executive teams who’ve spent more time and money putting together a killer “strategic roadmap” deck (or paying consultants to do the same) than they have actually communicating what that plan means for the employees of the newly formed or acquired organization.

We partnered with a technology company facing this challenge. The company had undergone multiple acquisitions over the past few years and had entered the initial stages of a major merger with two additional companies. The merger was designed to enable the organization to expand to a global footprint. The organization aimed to diversify into complementary product offerings as part of an ambitious strategy to quadruple revenue over several years.

One of the first things this company’s executives told our team was along the lines of, “We’ve laid out the strategy, now we just need to execute it.” Teammates in the next layer down in the organization offered a contradictory point of view, saying, “We’re ready to execute, we just need to know the strategy.”

In fact, despite developing a comprehensive and robust strategy for both the immediate future and the next three years, only 12% of Directors and above actually agreed that teams within the company shared the same perspective of success. Throughout the entire organization, only 29% of employees agreed that they were routinely updated on the status of organizational objectives. As a result, lower-level employees felt they had few other options than continue running “business as usual,” while senior employees scrambled to meet with each other in ad hoc meetings to try to understand the bigger picture.

Furthermore, an uncertain strategy almost ensures an uncertain future for your employees. While employees may be excited about the new company swag, that new water bottle or phone charger won’t keep them from wondering if management really has a plan. A great strategy is a great start - but ensuring that those people actually executing it understand it is crucial.

Read more about how we recommend aligning an organization around strategy and a case study study to see it in action.

Unplanned Turnover: When Company Leaders Become Company Leavers

In the aftermath of any major reorganization, employee attrition rates usually increase. A Towers Watson survey found that 88% of companies undergoing M&A activity met their strategic objectives when they identified and retained key employees to target for retention. Companies who failed to identify and retain such employees saw their success rate drop to 67%.2

There are many elements that companies consider when identifying their most important people: job function, human resource data, “high potential” status, leadership perception, etc. While there are pros and cons to each of these considerations, what many organizations fail to explore is each employee’s role in the organization’s network.

At McChrystal Group, we practice Organizational Network Analysis to understand how an organization is currently communicating, making decisions, and innovating. Through this analysis, we move beyond examining the way an organization is structured, to instead observe how it is actually operating.

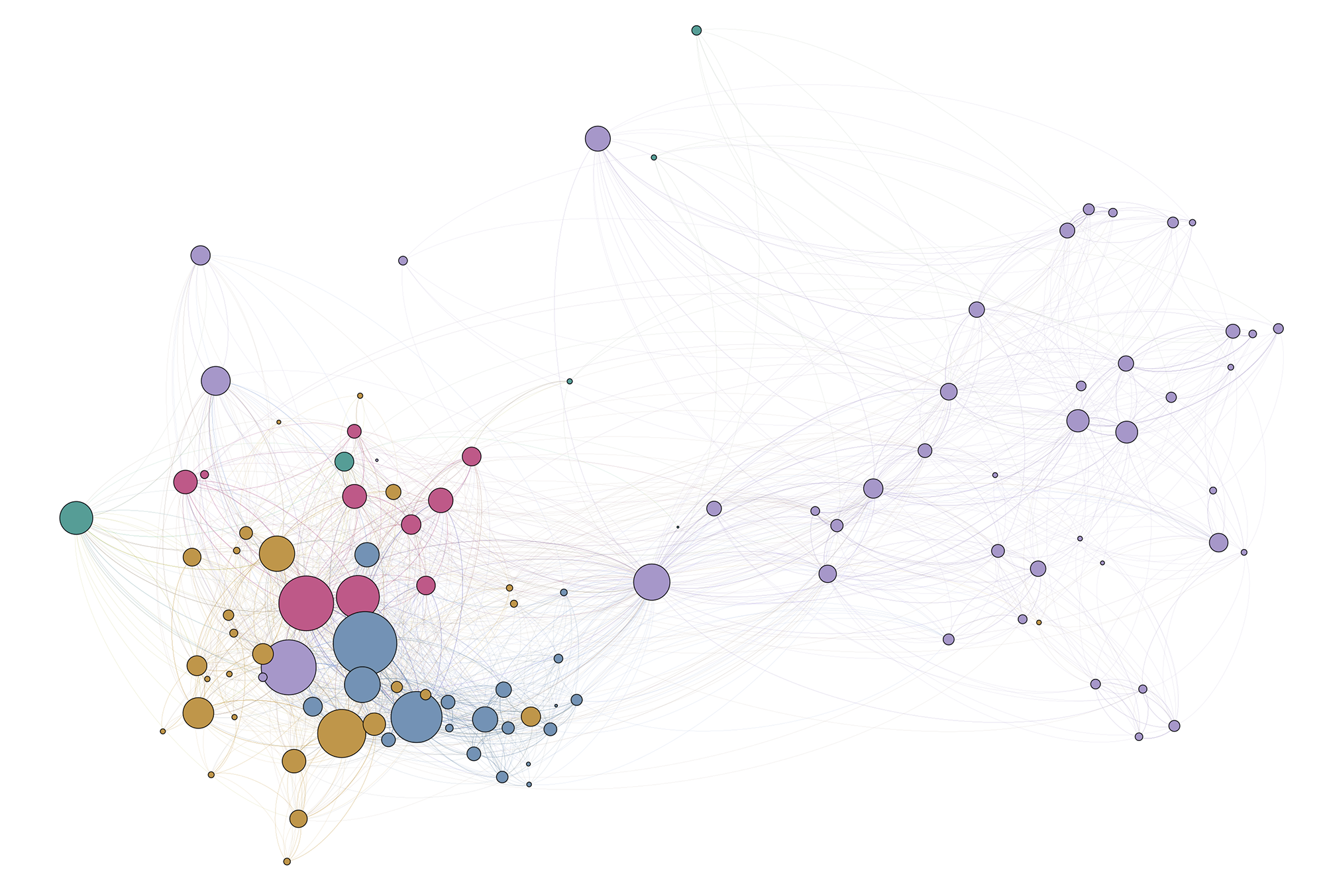

We partnered with a healthcare company that had undertaken multiple major transactions in the past five years but had spent little energy understanding the acquisition’s intrinsic communication and decision-making networks. The company had similarly failed to maintain important connections between different teams, and had seen a dramatic rise in both planned headcount reductions, and unanticipated regrettable attrition as backlash. As a result, different teams within the organization often found themselves disconnected and isolated. This presented a particularly major challenge when teams were required to coordinate towards larger strategic objectives.

In this network diagram, we see two disjointed groups. On the right side is a team that has been tasked with delivering a new service to clients. The service represents a major strategic bet for the organization, one that leadership hopes will grow to a significant portion of their overall revenue. On the left side are various supporting teams that leadership has tasked with selling the service to existing customers, providing technical support to the team on the right, and ultimately integrating the service into the company’s larger portfolio.

Despite the importance of this project, the two groups are almost exclusively linked together by a single individual, represented as the purple dot in the center of the network. At the time, there had been no explicit efforts to either retain that employee or reinforce their position in case of attrition. That specific employee’s situation epitomized a larger challenge throughout the organization: just 5% of their employees accounted for 50% of all valuable information flow throughout the company, meaning that a relatively small number of departures could severely disrupt the business.

Some amount of turnover is inevitable, especially during M&A activity. Understanding how an employee’s departure would impact the organization is crucial to identifying how to make the deal succeed.

Read more about how you can use network analysis to improve your understanding of key individuals within your organization and build a highly resilient network.

Unrealized Synergies: The Death of a Sales Plan

Though executives often cite potential synergies as a key argument for M&A deals, few companies are actually equipped to realize those synergies after the deal closes. Across our assessments, we’ve found that only 31% of employees agree that their organization has established processes to disseminate lessons learned or best practices throughout the organization. This challenge often becomes even more problematic in recently merged companies because there aren’t the same organic connections between employees to help make up for the lack of processes. This issue often manifests itself most immediately in sales teams. In fact, a McKinsey study noted that about almost half of respondents pointed to “sales and marketing capabilities as the most critical gap in their integration teams.” 3

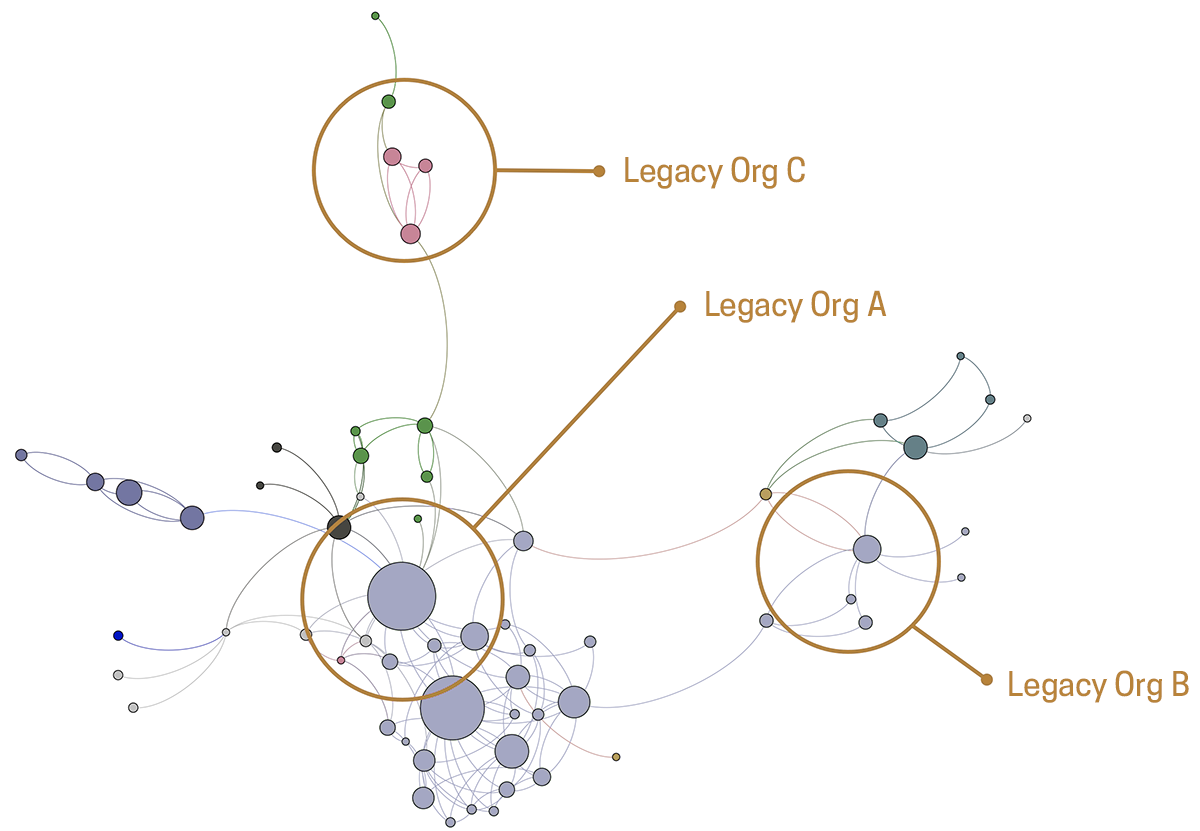

McChrystal Group recently partnered with a software company that had recently formed as the result of a merger between three organizations. While each brought identified market strengths and client relationships to the newly combined company, the company knew it was not making the most out of the new sales team. Through our analysis, we discovered two key barriers to fully leveraging the potential of that team:

- Though there were three legacy organizations, Legacy Org A was the undisputed center of the sales network. The newly combined sales team was led by the head of Legacy Org A’s sales team, which generally continued business as usual, limiting the extent to which they incorporated best practices, product knowledge, or client relationships from the other two companies. Employees at Legacy Orgs B and C had clients in need of Legacy Org A’s products, but there were no methods nor connections to move the sale forward.

- Meanwhile, Legacy Org B and C had no direct connections between each other, and received information only by seeking it out from Legacy Org A. Legacy Orgs B and C both had sales offices in regions that faced stricter government oversight, a challenge that had historically posed difficulties to Legacy Org B, but had been solved by Legacy Org C. Despite the valuable experience gained Legacy Org C, Legacy Org B continued to struggle as it failed to link the appropriate knowledge holders with those facing the problem.

In this case of the software client we mentioned above, the sales team was able to leverage the insights we provided in order to proactively address the challenges before they became the normal way of doing business.

Read more about how McChrystal Group works with organizations to connect key cross-functional stakeholders leveraging fusion cells, creating a deliberate operating rhythm, and improving communication forums to produce results.

Conclusion

There are many things that can go wrong when trying to bring together separate companies with their own histories, products, and cultures. To maximize your chances of success, you need to truly understand the companies involved in the deal, the importance of each employee and their understanding of the strategy, and how you’ll develop the systems and networks to ensure post-deal execution.